More reasons to invest in bonds with Catalyst Core

By trading bonds online, we eliminate manual processes across the traditional value chain, so you can benefit from lower costs. We direct your bond order to an optimised dealer auction, where up to 40 of the largest bond liquidity providers compete to return the best price.

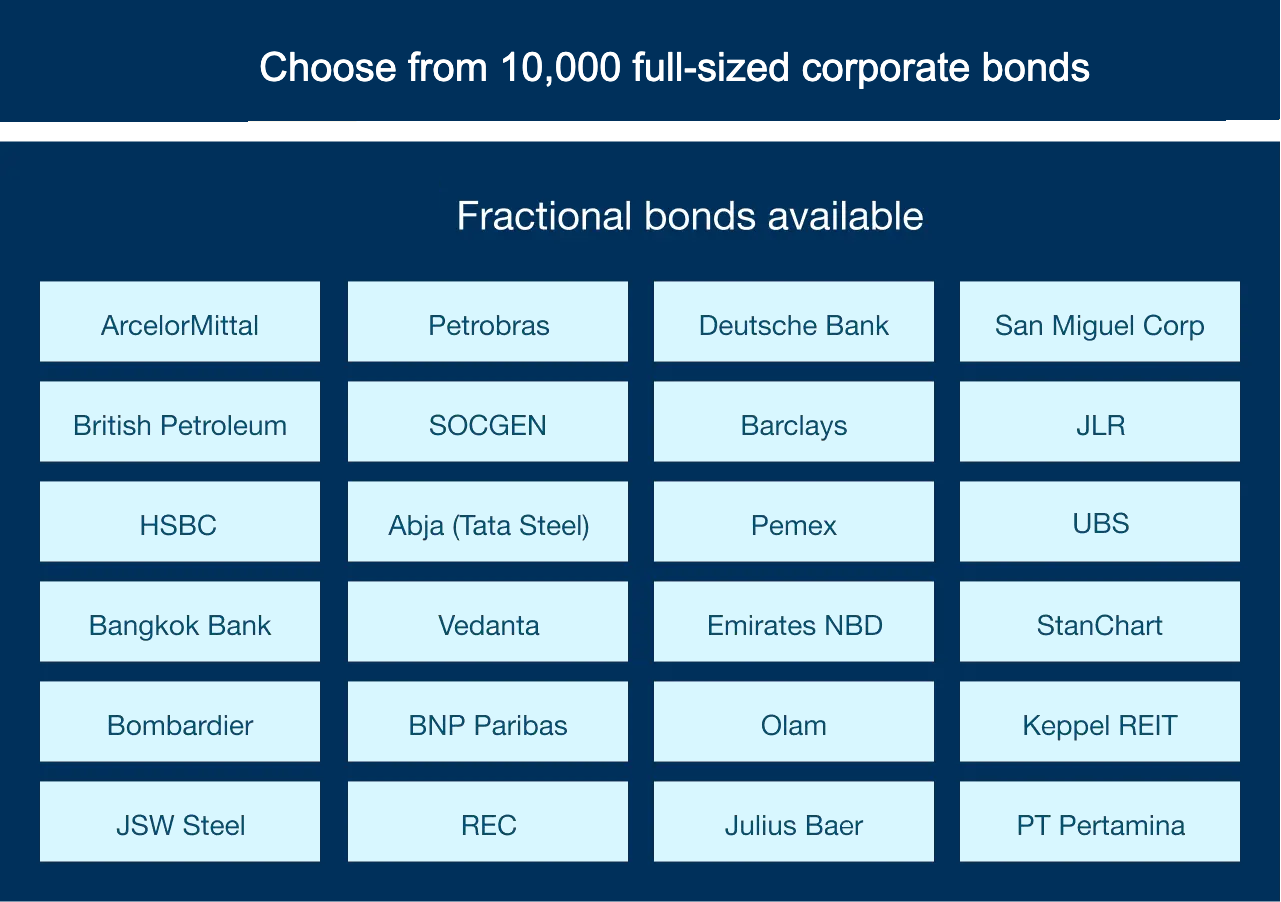

Access over 5,200 government (including Treasury bonds) and corporate bonds from global markets, allowing you to easily spread your investments across regions and sectors to manage risk effectively.

You can trade bonds online with fully digitised trading in our platform, so you can react swiftly to changing market conditions and easily manage your fixed income strategy.

With our quick execution and streamlined setup to buy and sell bonds online, you can adjust your portfolio quickly and while on the go to help you stay resilient against market fluctuations. Our trading platform uses smart order routing to scan multiple venues, ensuring optimal execution and competitive pricing for your investments.

Enjoy webinars, podcasts, daily articles, and long-form publications from our team of top-tier strategists.

We’re a regulated Danish bank. This means we’re under the supervision of the Danish FSA and comply with stringent reporting requirements and client management regulations.

Your funds are protected via the Danish Guarantee Fund up to USD 100,000.

Your securities are also protected by the Danish Guarantee Fund. Generally, securities would be returned to you in cases like suspension of payment or compulsory winding up. If we’re unable to return them, they are covered up to USD 20,000 per client.

Bond trading FAQs

You can trade bonds online 24/5 if the underlying bond market is open. Trading hours are limited to the daylight hours in the region where liquidity in the underlying bond market is best.

We offer you greater control of your trading via our fully customised orders.

Our policy is designed to ensure client orders are executed promptly, efficiently, and with the best possible terms.

Bonds offer the potential for stability, fixed income, and portfolio diversification. However, their value can be influenced by interest rate changes, credit risks, or market pricing conditions, such as bonds trading at a premium or discount, so it’s important to understand the factors that affect bond performance.

With an account, you get access to a wide range of online bonds, including corporate and government bonds (including Treasury bonds such as UK gilts and US Treasury bonds not limited to these countries) so you can invest in opportunities that align with your goals.

That depends on the account type you open.

For an individual account, these are the documents you’ll need to provide:

- Your national ID number from the country where you hold citizenship.

- Your tax ID number from your country of residence.

- A document as proof of identity (e.g., a passport, ID card, driver’s licence) and a selfie.

- A document as proof of residence (one that shows your home address, such as a residence permit, utility bill, or bank statement).

Most sign-ups for individual accounts are approved digitally within a few minutes. However, since we cannot compromise on security checks, the process can sometimes take longer. If all documents you provided meet requirements, we’ll process your application within 2 working days.

If you provide clear copies of all required documents, corporate accounts will generally be approved in about 1 week.